🚀 TL;DR

Mercury is a fintech platform offering startup-friendly banking and financial tools.

Co-founded by Immad Akhund (formerly cofounder of Heyzap), Mercury launched in 2017.

In March 2025, Mercury raised a $300M Series C led by Sequoia, doubling its valuation to $3.5B.

Today it serves startups with tools like business accounts, cards, payment rails, venture debt, and more.

Risks: bank partner dependencies, regulatory/compliance complexity, margin pressure, tech resilience.

What to watch: migration of partner banks (e.g., move off Evolve), expansion of product stack beyond banking, and retention of high-growth startup customers.

📇 Snapshot

Founded: 2017 (Immad Akhund, Max Tagher, Jason Zhang)

HQ: San Francisco, California. Sector: Fintech / Banking for Startups. Latest raise/valuation: $300M Series C, March 2025, $3.5B valuation.

2024 ARR (est.): $500M, up 97% YoY from $254M in 2023.

Customers: Startups; business banking, corporate cards, venture debt, spend & payments tools, APIs & financial operations tooling.

Via Forge

Elevator pitch: Mercury is the banking + finance OS for startups, emphasizing no banking friction, clean APIs, built-in tools, and product-led experience.

🧠 Immad Akhund’s Path & Mindset

Immad Akhund is the public face of Mercury. Before this, he co-founded Heyzap, a mobile developer tools company, which was acquired in 2016. Mercury+1 His prior experience in building dev tools gave him a deep sense for product infrastructure and developer experience.

He often talks about mistakes, iteration, and what it takes to build a product you believe in. In a First Round Review podcast, Immad describes the urgency he felt: he didn’t want Mercury to be “just another bank”; rather, he wanted it to be the financial backbone for the next generation of builders.

His leadership style blends transparency, product humility, and high standards. He’s known to bring up culture early, write down traits, and align hiring and operations tightly with those traits.

Because of his identity and journey, Mercury’s narrative often leans on “banking that understands builders,” “decode financial ops,” and “remove friction.” That narrative is also a moat in a crowded fintech space.

📈 Growth Journey

Phase 1: Laying the Foundation (2017–2019)

Building a minimal banking experience for startups with clean UX, API integrations, and tools that other banks lack.

Early traction among early-stage SaaS startups who needed better cash management, wire support, cross-border payments, etc.

Phase 2: Product Depth & Expansion (2020–2023)

Introduced new features: corporate cards, venture debt, analytics, payments tools.

Benefited heavily from the collapse of SVB in March 2023; startups moved deposits and banking to digital platforms, including Mercury.

Grew deposits, expanded user base, strengthened product reliability.

Phase 3: Scaling & Risk Management (2024 → 2025)

Launched consumer banking in April 2024 (a risky expansion) while continuing B2B / startup core.

Managed a bank partner data breach (Evolve Bank & Trust) in mid-2024, prompting a pivot in partnerships.

In 2025, Mercury announced the plan to drop Evolve and migrate customers to partner banks like Column N.A. and Choice Financial.

The Series C in March 2025 injected $300M and revalued Mercury at $3.5B.

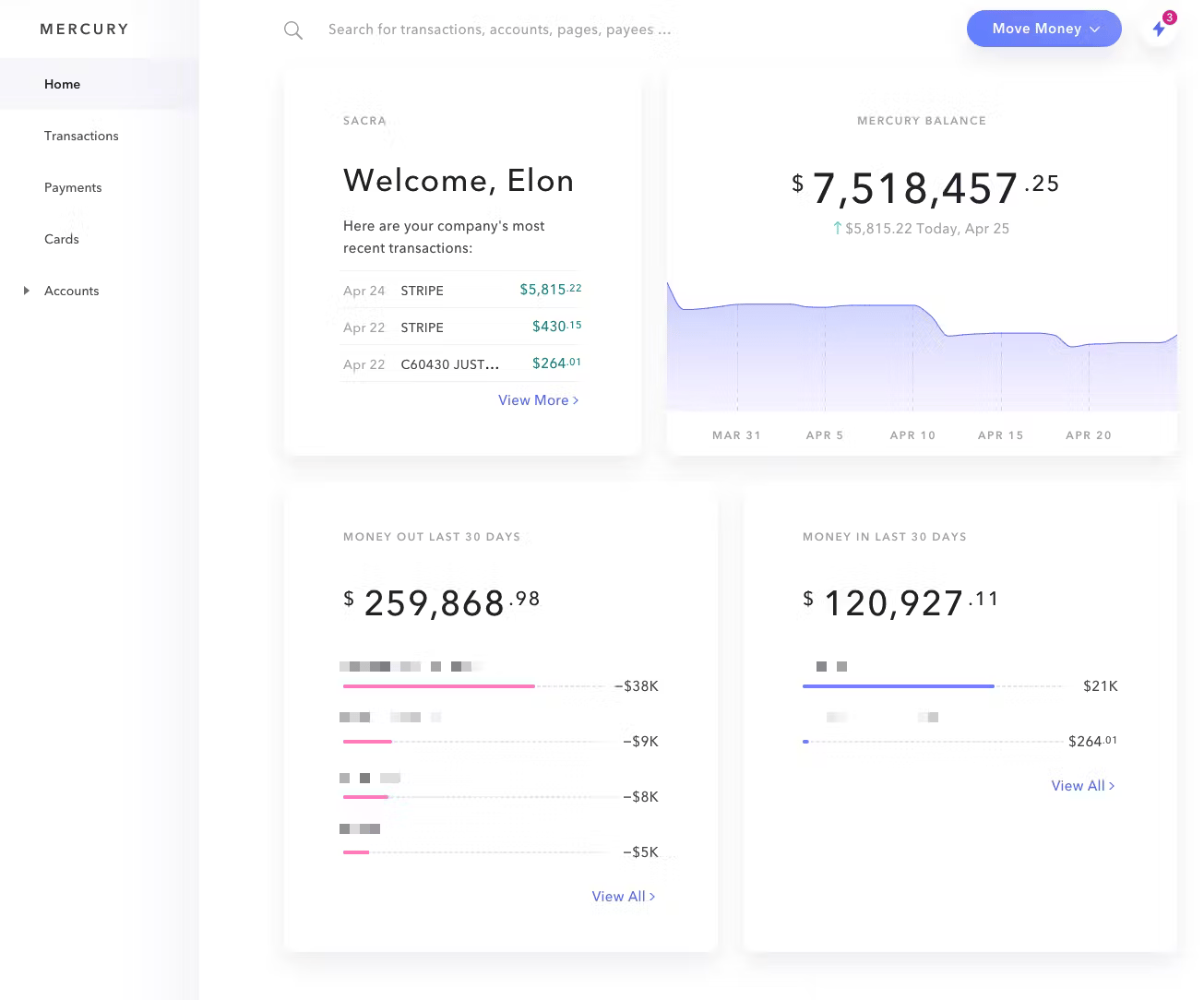

Via Sacra

💸Product 101:

Mercury has scaled to serve over 200,000 businesses by solving a problem traditional banks never figured out: how to actually work the way startups do.

Mercury web dashboard: balance, accounts, invoicing, cards, and bill pay in one clean view.

Banking That Just Works: Mercury partners with Choice Financial Group, Column N.A., and Evolve Bank & Trust to offer checking and savings accounts with FDIC coverage up to $5M through sweep networks. You can handle everything you'd expect: domestic ACH, wires, checks, international transfers, and FX. But here's the difference: every account comes with clean API access so you can automate payments, check balances, and batch transactions without drowning in manual work.

Cards That Scale With Your Team: Issue unlimited debit cards and Mercury's IO credit card (with 1.5% cashback) instantly as virtual cards. Lock spending by merchant, set individual limits, and integrate with your payroll system for bulk issuance. Role-based permissions mean you can give access without giving away control, and approve purchases right from Slack or your phone.

Mercury mobile: home balance, one-tap ACH, filtered transactions, and live card controls in one flow.

Financial Ops Without the Chaos: Mercury's Bill Pay uses AI to capture and parse incoming invoices, flag duplicates, and route approvals through Slack or mobile. On the invoicing side, create branded invoices and accept payments via card, Apple Pay, Google Pay, wire, or ACH, all automatically matched and synced to QuickBooks, Xero, or NetSuite. The platform handles transaction categorization, GL mapping, receipt policies, and even employee reimbursements without leaving Mercury.

Capital When You Need It: Mercury's IO credit comes with startup-friendly underwriting tied to your cash balance rather than traditional metrics. They also offer venture debt and working capital loans with flat-fee structures, plus treasury products that let you earn yield on idle cash with same-day liquidity and automatic sweeps.

What Makes Mercury Different: Mercury's biggest competitive advantage isn't any single feature. It's that everything lives in one place. The platform reduces tool sprawl by combining banking, accounts payable/receivable, and month-end close into an integrated workflow. Once your payment flows, corporate cards, and accounting rules live inside Mercury, the switching costs get high fast. And with developer-first APIs and automation hooks throughout, it's built for teams that want their banking to feel more like software than paperwork.

Web home: balance trend, recent transactions, and 30-day cash in/out at a glance.

🛡 Strategic Edge

Developer-first experience & APIs: Mercury’s design is deeply developer- and startup-native: everything from opening accounts to wiring money is built for low friction. That matters when founders are time-starved.

Integrated financial tooling: Beyond banking, Mercury layers analytics, spend tools, venture debt, and payments, making it harder for customers to swap out pieces.

Bank partner model with optionality: Because it doesn’t hold a bank charter, Mercury can pivot partners (as seen with moving off Evolve) and choose specialization in operations rather than regulatory burden.

Narrative trust & positioning: Once an OEM integrates deeply, ripping it out would be painful.

Risk & moat: Switching costs are meaningful once a startup’s operations tie into Mercury’s APIs. Dislodging that integration would be expensive.

Competitors:

Neobanks focused on SMBs (Brex, Ramp) may lack depth in APIs or financial ops tools.

Traditional banks have legacy systems and lack developer-friendly UX.

Some fintechs target verticals; instead, Mercury stays horizontal across tech-enabled companies.

Mercury’s competitive set across startup banking, spend, and treasury.

Mercury vs the field: Brex and Ramp overlap on cards and spend; Rho, Relay, and Arc on banking plus AP and credit; Stripe and Wise act as rails for embeds and cross-border; JPMorgan, SVB, and Bluevine cover classic SMB banking and lending.

📊 Current State & Risks

Status & Traction:

Nonlinear lift: volume roughly doubled from 2021 to 2023 and grew ~50% in 2024—pointing to a product-led flywheel across cards, payments, and AP. The watch is whether that pace holds through partner-bank shifts.

$300M Series C at $3.5B as of March 2025.

Expanded product suite beyond pure banking.

Customer base includes many scaling startups that rely on Mercury’s stack for daily operations.

Tailwinds:

The shift toward embedded finance and fintech ops tooling.

Digital-first, distributed startups demand better banking.

Regulatory openness for fintech innovation, banking APIs, and embedded payments.

Risks:

Bank partner dependency: Any weakness in partner banks (compliance, tech, reputation) can cascade to Mercury.

Regulation & compliance burden: As Mercury grows, oversight will intensify.

Margin pressure: Banking is capital-intensive; revenue per account may compress.

Operational resilience: Uptime, fraud, and cybersecurity are critical, especially given that startups have zero tolerance for banking downtime.

Signals to watch:

If startups begin migrating away or reducing dependence on Mercury.

If the customer acquisition growth slows or churn bumps.

If new banking partners introduce friction or regulatory constraints.

🧭 Bottom Line

Mercury is more than just a fintech startup, it’s building the financial spine for the next generation of founders. With Immad Akhund’s product-first lens and startup empathy, Mercury has earned trust in a fractured banking world.

For our community, his story is instructive: bridging identity, product, and mission in a domain full of friction. A founder-centric bank built by a founder. That’s rare.

Want us to dig into Mercury’s revenue structures, partner bank playbook, or future product roadmap next? Just reply “Deep Dive” + Mercury

At Dhow, we back builders who chart new waters. Immad Akhund and Mercury are turning banking into software you can actually use. One place for checking, payments, cards, bill pay, and clean APIs. Fewer tools. Fewer mistakes. Faster closes. In a multi-billion-dollar market, that simplicity becomes the default, and switching gets painful. That’s how categories get defined and revenue compounds. Join the movement, share this with a friend (or two).

Crypto’s Most Influential Event

This May, Consensus will welcome 20,000 to Miami for America’s largest conference for crypto, Web3, & AI.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus is your best bet to market-moving intel, get deals done, & party with purpose.

Ready to invest in your future?

Secure your spot today.

If you enjoyed this, you’d be doing us a HUGE FAVOR by just clicking the ad above - we appreciate it!

Sources

Mercury blog: Announcing Mercury’s $300M Series C at a $3.5B valuation (primary + secondary) (Mercury) Mercury

BusinessWire: Mercury Announces $300M Series C Round at $3.5B (BusinessWire) Business Wire

TechCrunch: Mercury lands $300M in Sequoia-led Series C, doubles valuation to $3.5B (TechCrunch) TechCrunch

Wikipedia: Mercury Technologies — founding, history, bank partner change, funding summary (Wikipedia) Wikipedia

First Round Review: Immad Akhund on culture, iteration, and the founding arc of Mercury (First Round Review) First Round+1