🚀 TL;DR

Private markets are moving from “institutional only” to “retail-friendly.” Less companies going public + diminished real estate returns will lead to increased movement to the private markets.

Nearly 60 percent of financial advisors now plan to allocate 10 percent or more of client portfolios to private markets, with 30 percent targeting 20 percent or greater. This is behavioral change, not speculation. Seventy percent of advisors cite that facilitating private market investments strengthens client relationships, making private market access a competitive necessity.

Allocate is building an operating system for private-market investing, built for wealth advisory firms and family offices.

In early September 2025, Allocate announced a $30.5M Series B, bringing total capital raised to $64M.

Allocate reports $2.7B+ assets on platform (as of 11/01/2025), 320+ wealth advisory firms, and 3,500+ platform users.

Founder Samir Kaji comes from nearly 22 years in venture banking (SVB + First Republic), and Allocate is essentially his playbook turned into software.

Where this gets interesting for Dhow: Allocate is one model of access. Dhow is another. They serve different capital journeys. But Allocate falls within the type of Company we would invest in given its Muslim-origin founder.

📇 Snapshot

Company: Allocate

What it is: Private markets operating system for advisors and family offices

Founded: 2021

HQ: San Francisco Bay Area (Allocate describes itself as serving wealth advisors and family offices; press coverage places it in the Bay Area)

Latest round: $30.5M Series B (announced Sep 3, 2025)

Total funding: ~$61-$64M

via crunchbase

Scale (reported): $2.7B+ assets on platform as of 11/01/2025

Elevator pitch: Allocate is trying to be the interface that lets advisors and family offices source, administer, and track private-market exposure without running everything through spreadsheets, PDFs, email chains, and “who knows that GP.”

🧠 Samir Kaji’s Arc

Samir’s background is unusually specific. It’s not just “finance.” It’s venture plumbing (VC Banking).

Allocate’s own founder bio says Samir spent nearly 22 years in venture banking across SVB and First Republic, advised 700+ venture capital and private equity firms, and completed $12B+ in structured debt transactions.

That matters because the private markets are not failing due to lack of demand. They fail at scale because the mechanics are brutal:

subscriptions and capital calls

K-1s and tax timing

fund documents everywhere

cash drag that nobody tracks cleanly

allocations that are hard to explain to real humans

People love “alts.” People hate “alts operations.” Samir’s edge is that he lived inside that mess for two decades and saw where time and trust get burned.

Allocate is basically the bet that the next wave of private-market growth will be won by whoever builds the simplest interface for it.

🧩 Product 101: What Allocate Actually Does

Allocate positions itself as “modern infrastructure” for private markets, built for wealth advisors and family offices.

Allocate emphasizes a few core pieces:

A) Portfolio management + tracking

Centralize client private-market investment data, including positions that exist outside Allocate’s own vehicles.

B) Curated private-market opportunities

Access to venture, private equity, private credit opportunities (Allocate markets this as “vetted opportunities”).

C) White label solutions

Tools that allow firms to launch customized and branded funds.

And importantly, Allocate has been building “platform surface area” through acquisition too. In July 2025, it announced a strategic asset acquisition of The Coterie’s platform to accelerate its vision for private markets infrastructure.

If you squint, the direction is clear: become the place where private-market allocation gets proposed, executed, tracked, and explained.

📈 Traction: What We Can Verify

Here’s what Allocate itself is currently publishing:

$2.7B+ assets on platform (as of 11/01/2025)

320+ wealth advisory firms

3,500+ platform users

And here’s what Allocate said in the September 2025 funding announcement (via its lead investor’s write-up and major syndication):

“over $2.5B in assets on platform” and “over 1,200 wealth advisory firms and institutional family offices” (as described in Portage’s post about the round).

The same Series B announcement is syndicated on Business Wire and Yahoo Finance, including $30.5M Series B and $64M total raised.

These figures are directionally consistent, but they are not identical. The clean way to interpret the mismatch is: Allocate’s public “by the numbers” block is a point-in-time snapshot (dated 11/01/2025), while the press announcement is describing broader “served” relationships and earlier platform scale. We are keeping both, with dates and sourcing, rather than forcing one “clean” number.

🌊 Why Allocate Exists Right Now

The wealth channel is pushing harder into private markets, and the big firms are building products to meet it.

One clean signal: BNY Wealth’s family office work notes ongoing capital shift toward private markets and direct investing trends among family offices.

At the same time, large managers keep rolling out structures to bring private credit and private assets into wealth portfolios with lower minimums and more “fund-like” wrappers.

This is the backdrop for Allocate. The demand side is real. The wealth side wants exposure. The friction is operational, compliance-heavy, and constant.

So the opportunity is not just “deal access.” The opportunity is: make private markets behave like a modern product.

🛡 Risks and Real Questions

Allocate’s story is compelling, but the hard questions are still the right ones.

1) Private markets are not a normal asset class for normal clients

Liquidity is constrained. Time horizons are long. Dispersion is huge. If the platform experience becomes too “easy,” the risk is that expectations get mis-set.

2) Quality control at scale

As advisors and family offices expand exposure, the temptation is to widen the funnel. The platform wins long-term if the outcomes stay strong. “More deals” is not the same as “better portfolios.”

3) Stickiness is earned, not assumed

High switching costs exist once reporting, workflows, and client communications live inside a system. But advisors will churn if product trust breaks, especially around reporting accuracy and operational reliability.

4) The market is crowded

Big managers are building wealth rails. Fintechs are stacking toolkits. Private-market admin and data layers are evolving fast. Allocate’s edge has to remain clarity, execution, and distribution.

🧭 Two Models of Access, One Market in Transition

Allocation represents the maturation of private-market infrastructure.

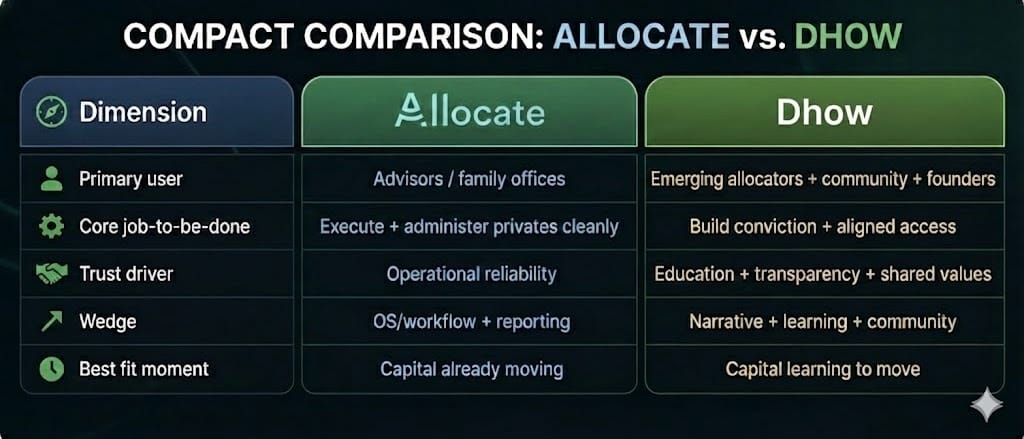

Allocate is built for allocators who already participate in venture and alternatives at scale. The platform emphasizes efficiency, credibility, and access to managers and products that fit a private portfolio. It assumes financial literacy, existing capital, and repeat allocation behavior. In that world, it makes sense.

Dhow comes from a different impulse.

We are building for investors and founders who want to understand before they allocate. We lead with context. Founder stories. Sector dynamics. risk framing. Capital follows insight, not the other way around.

This difference shows up in how trust is built. Allocation relies on network effects and institutional signaling. Dhow relies on education, transparency, and shared values. One optimizes for access. The other optimizes for alignment.

Neither model replaces the other. They serve different moments in an investor’s journey.

As private markets expand beyond a small set of institutions, new platforms emerge to meet new types of capital. Some organize capital that already moves. Others help capital learn how to move.

That distinction matters.

Founders like Samir exist because this transition is underway. Platforms like Allocation professionalize access, while platforms like Dhow build conviction. Together, they reflect a market that is no longer closed, but not yet evenly understood.

✅ Bottom Line

Allocate is a sharp bet on where private markets are headed.

Private markets aren't staying private. More advisors are moving more clients into them. More portfolios need private exposure as a standard holding. The real winners aren't the ones that promise easy answers. They're the ones that strip away the friction without overselling the upside.

Samir Kaji’s edge is not a trend. It’s repetition. Two decades inside the machine, turned into product.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

If you enjoyed this, you’d be doing us a HUGE FAVOR by just clicking the ad above - we appreciate it!

Sources:

Allocate: “Allocate by the numbers” (assets on platform, firms, users; as of 11/01/2025). Allocate

Business Wire: “Allocate Raises $30.5 Million Series B to Modernize Private Market Investing” (round size; total raised).Business Wire

Portage Ventures: “Allocate Announces $30.5 Million Series B…” (round context; reported scale and customer counts in the announcement).Portage Invest

Yahoo Finance syndication of Allocate Series B announcement (round details; participation).Yahoo Finance

Allocate About page: Samir Kaji founder background (venture banking tenure; firms advised; transaction volume).Allocate

Business Wire: “Allocate Announces Strategic Asset Acquisition of The Coterie’s Platform…” (acquisition and rationale). Business Wire

BNY Wealth: “2025 Investment Insights for Single Family Offices” (context on private markets trend among family offices). Wealth Management Services

Barron’s summary of BNY Wealth survey findings (private equity allocation trends among wealthy families). Barron's

Reuters: “KKR and Capital Group launch funds…” (wealth-channel products blending public and private credit; minimums).Reuters