🚀 TL;DR

2025 was the year Dhow went from an idea to a real company and movement.

We conceptualized Dhow in late Q1 and began operating in early Q2. Since then, everything you see today has been built from scratch. We published consistently, engaged deeply with founders and investors, generated early revenue, and laid the groundwork for the product and platform we intend to launch next year.

At the same time, private markets continued to evolve in meaningful ways. Capital flowed toward founders building durable infrastructure across AI, developer tooling, autonomous systems, etc. Several of those founders come from our community, and their progress matters.

This dispatch is a year-end reflection. It covers what we built, where we are going, and three recent funding rounds that reflect the kind of long-term value creation we care about.

What to watch: Product development through the end of this year, an app and first fund launch in Q1 2026, and longer-term work toward broader investor access and secondary liquidity.

1 | What We Built in 2025

This year was about foundations.

Our goal with Dhow is to redirect Muslim capital from scattered, passive savings into ownership, putting everyday Muslims on the cap table of serious Muslim founders building outlier companies. It was sparked by the Gaza genocide and the realization that, despite being nearly two billion people, Muslims lack organized institutions and capital power, so our money often ends up strengthening banks, funds, and platforms that don’t reflect our values or dignity.

Dhow is framed as economic self-defense as we build leverage through ownership and stop begging for a seat at the table.

Dhow is resistance.

Dhow was first conceptualized in late Q1 of 2025 and became an operating company in early Q2. Everything that exists today, from the newsletter to our early community to the internal systems we are building, has been created within that window.

Over the course of the year, we engaged with hundreds of founders, institutional investors, and private investors. The quality of those conversations truly stood out to us. People were thoughtful, curious, and generous with their time. That level of engagement reinforced for us that the need we are addressing is real.

From a distribution standpoint, we focused on writing and conversation rather than scale. Between Reddit, the newsletter, and our social channels, we reached hundreds of thousands of impressions. For a bootstrapped effort this early, that signal mattered more than raw numbers.

We published 15 newsletters between July and the end of the year and generated revenue directly through that channel. More importantly, the writing process helped us sharpen our thinking, develop a consistent voice, and build trust with readers who care about accuracy and depth.

All of this was done without external capital. We bootstrapped intentionally, knowing that the first year was about learning, not rushing to ship something half-formed. By the end of 2025, we had the foundations of a real network and a clear sense of what comes next.

2 | The Road Ahead

We think about Dhow as a long-term project. The roadmap reflects that.

Phase 1: Q4 2025 (Current)

We are currently focused on product development and strengthening the community layer. This phase is quiet by design. It is about building systems correctly before putting them in front of users. We’ve established what inputs are needed, what we own, and how we’ll integrate it all into a holistic investment experience on our platform.

Phase 2: Q1 2026

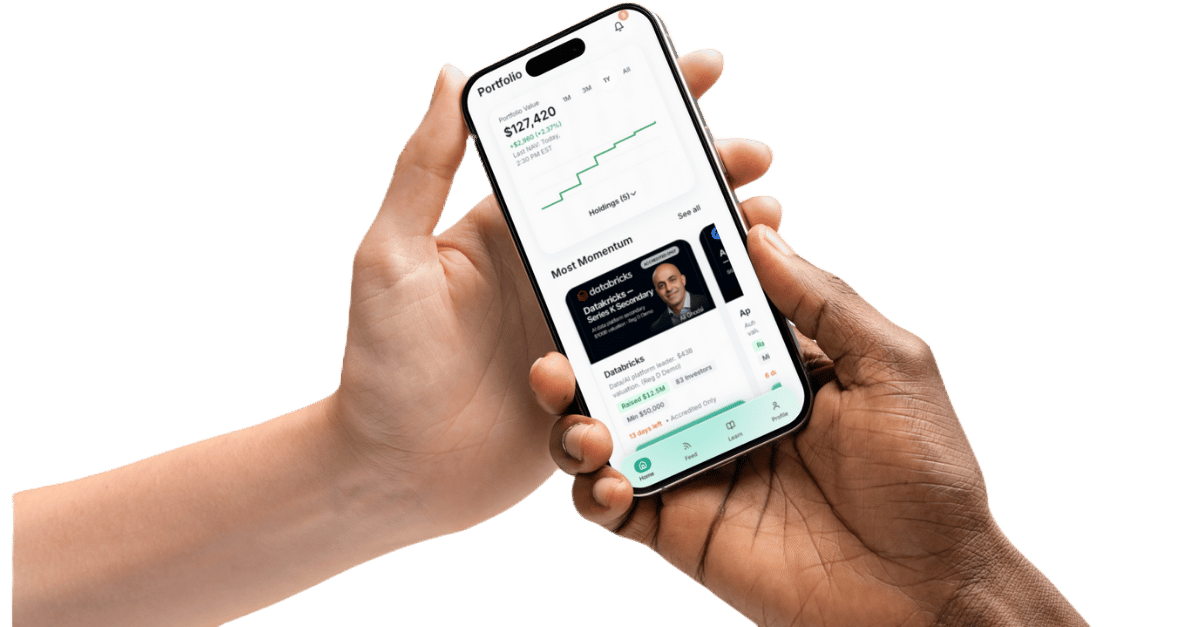

We plan to launch a fully functional Dhow app and introduce our first Dhow fund. The goal here is to move from content and context into structured participation, without compromising education or alignment.

Phase 3: Q1 2027

We intend to pursue a broker-dealer license and expand access through Regulation CF and Regulation A structures. This phase is about widening access responsibly and meeting people where they are, not forcing complexity too early.

Phase 4: 2028 and beyond

Longer term, we are looking at tokenization, secondary liquidity, and cross-border trading rails. These are complex systems that only work if the underlying trust and infrastructure are solid. We are comfortable treating this as long-dated work.

3 | Signals from the Market

One of the reasons we started Dhow was to track where real capital is going and why. Toward the end of this year, three funding rounds stood out. Not because of hype, but because of what they signal about durable value creation.

Databricks (Ali Ghodsi)

Databricks builds a unified data and AI platform that sits at the center of modern enterprise infrastructure. In December 2025, the company raised over $4 billion at a reported $134 billion valuation. This was one of the largest private software financings ever completed.

The significance here is not just the size of the round. Databricks has positioned itself as core infrastructure for how large organizations manage data, analytics, and AI workloads. That makes it difficult to replace and deeply embedded in customer operations. The market is rewarding that durability.

Cursor / Anysphere (Sualeh Asif and team)

Cursor is an AI-assisted development environment designed to improve how engineers write and understand code. In November 2025, its parent company Anysphere raised $2.3 billion at a valuation of approximately $29.3 billion.

This round reflects a broader shift in how value accrues in AI. Rather than concentrating solely at the model layer, capital is flowing toward tools that sit directly inside daily workflows. Cursor’s growth shows that developer experience remains one of the most valuable surfaces in software.

Applied Intuition (Qasar Younis)

Applied Intuition builds software infrastructure for autonomous systems, spanning simulation, validation, and vehicle operating systems. In June 2025, the company raised $600 million at a $15 billion valuation, more than doubling its valuation from the prior year.

What stands out about Applied Intuition is its focus on real-world systems. The company operates across automotive, industrial, and defense use cases. That breadth creates resilience. It also explains why investors are willing to back the company through longer development cycles and regulatory complexity.

4 | Why These Rounds Matter

Taken together, these companies highlight a consistent pattern.

Infrastructure still wins. Platforms that become deeply embedded in workflows and systems tend to attract patient capital.

Developer and operator surfaces matter. Tools that sit close to daily decision-making and execution can scale quickly if they solve real problems.

AI tied to the physical world carries weight. When software connects directly to production systems, vehicles, or logistics, it creates defensible value that is harder to replicate.

For founders from our community, these outcomes are instructive. They show that scale, ambition, and technical depth are not out of reach. They also provide reassurance to more conservative investors that durable, large outcomes exist and can be identified early.

5 | What These Signals Actually Tell Us

Stepping back, the capital flowing into Databricks, Cursor, and Applied Intuition tells a consistent story about where private markets are still willing to underwrite risk.

First, infrastructure continues to command conviction. Databricks sits at the center of how enterprises store, govern, and operationalize data and AI. Applied Intuition plays a similar role for autonomous systems, providing tooling that becomes deeply embedded long before end products reach scale. These companies are not optional layers. Once integrated, they are hard to remove.

Second, workflow ownership matters. Cursor’s rise reflects how value accrues when a product lives inside daily execution. Developer tools that meaningfully change how work gets done can scale faster than expected, even in crowded markets, because they earn habitual usage rather than episodic attention.

Third, durability beats novelty. None of these companies are winning because they were first to market or because they promised instant transformation. They are winning because they solved specific problems well, invested heavily in product depth, and stayed close to real users over time.

For founders, the lesson is straightforward but not easy. Large outcomes tend to come from building things people rely on, not things they experiment with. For investors, it is a reminder that the most attractive opportunities often look operational and unglamorous before they look obvious.

These are the signals we pay attention to. Not because they guarantee outcomes, but because they reveal where fundamentals still matter.

🧭 Bottom Line

This year was about learning where substance shows up, both in our own work and in the broader market.

Dhow moved from concept to execution in a short period of time. We wrote, listened, and built relationships before trying to scale anything prematurely. That approach helped us understand where interest is real, where skepticism is healthy, and where long-term alignment actually forms.

At the same time, the companies we highlighted reinforce why we are taking a deliberate path. The market continues to reward builders who focus on infrastructure, clarity, and real-world use, even when those choices take longer to compound.

As we head into the next year, our priorities are unchanged: we’re building carefully while staying grounded in data. We’ll continue to highlight founders doing durable work and plan to expand access only when the foundations can support it.

We appreciate everyone who has read, shared, or challenged us along the way. This is still early, and that is exactly where we want to be.

Join the movement, share this with a friend (or two).

Banish bad ads for good

Your site, your ad choices.

Don’t let intrusive ads ruin the experience for the audience you've worked hard to build.

With Google AdSense, you can ensure only the ads you want appear on your site, making it the strongest and most compelling option.

Don’t just take our word for it. DIY Eule, one of Germany’s largest sewing content creators says, “With Google AdSense, I can customize the placement, amount, and layout of ads on my site.”

Google AdSense gives you full control to customize exactly where you want ads—and where you don't. Use the powerful controls to designate ad-free zones, ensuring a positive user experience.

If you enjoyed this, you’d be doing us a HUGE FAVOR by just clicking the ad above - we appreciate it!

Sources

Reuters: Databricks in talks to raise capital at $134 billion valuation (Series L context, valuation, and timing).

https://www.reuters.com/technology/databricks-talks-raise-capital-134-billion-valuation-2025-12-17/Yahoo Finance: Databricks talks to raise capital at $134B valuation (Reuters syndication confirming round size and valuation).

https://finance.yahoo.com/news/databricks-talks-raise-capital-134-191835076.htmlTechStartups: AI startup Databricks raises $4B at a $134B valuation to expand its enterprise data and AI platform.

https://techstartups.com/2025/12/17/ai-startup-databricks-raises-4b-at-a-134b-valuation-to-expand-its-enterprise-data-and-ai-platform/The SaaS News: Cursor secures $2.3B Series D at a $29.3B valuation (funding round, valuation, and developer tooling context).

https://www.thesaasnews.com/news/cursor-secures-2-3b-series-d-at-29-3b-valuationAI Business: Cursor raises billions as AI coding tools reshape developer workflows (adoption trends and developer behavior context).

https://aibusiness.com/generative-ai/cursor-raises-billions-continued-momentumApplied Intuition: Applied Intuition raises $600M Series F at a $15B valuation (official company announcement and valuation).

https://www.appliedintuition.com/news/series-fReuters: Applied Intuition valued at $15 billion in latest fund raise (independent confirmation and autonomy market context).

https://www.reuters.com/business/autos-transportation/applied-intuition-valued-15-billion-latest-fund-raise-2025-06-17/