✂️ TL;DR

via a16z

Andreessen Horowitz, in partnership with Mercury, published a transactions-based ranking of the top 50 AI application companies that startups are actually paying for.

The dataset covers 200,000+ Mercury business customers from June through August 2025, making this a rare view into real budgets rather than traffic or social buzz. Mercury also has a Muslim-origin founder, and we will feature the Company soon.

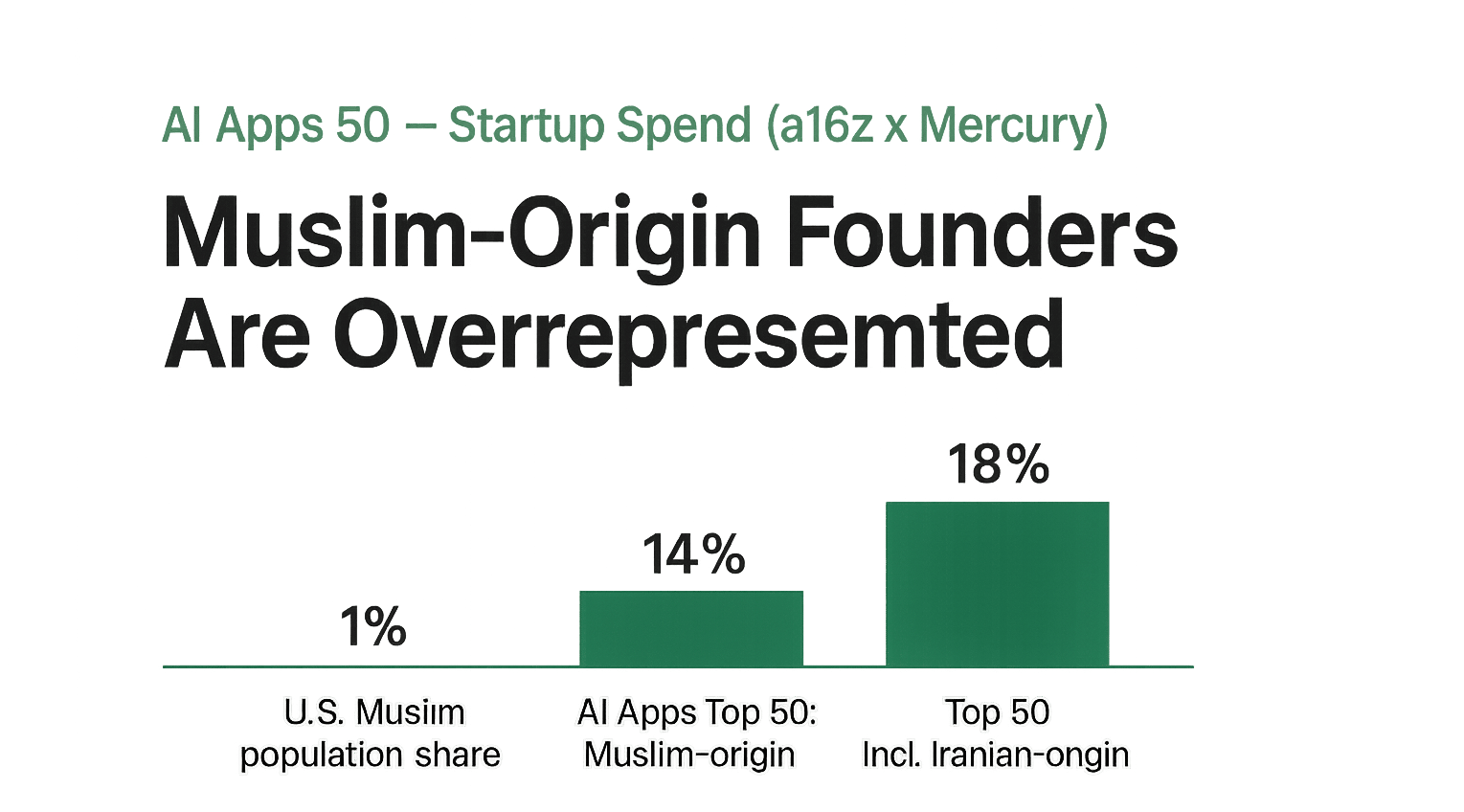

Within that ranking, three of the top ten and roughly 14% of the top fifty companies have Muslim-origin founders; expanding the lens to include Iranian-origin founders raises the share to about 18% by our count.

The core takeaway is not symbolic; rather, it is practical: the founder pipeline from our community is already converting to paid adoption.

🧾 Snapshot: What This Ranking Measures

The report identifies AI-application vendors by share of wallet in startup spending and excludes infrastructure such as cloud platforms or GPU providers. This makes the list a cleaner read on the tools that teams integrate into daily workflows to drive near-term outcomes.

The top of the board features OpenAI (#1) and Anthropic (#2). The notable surprise is Replit at #3, ahead of many general-productivity suites, with Cursor at #6 anchoring the “vibe-coding” cohort. Check out our feature of Replit here.

✨ Overrepresentation: Who Appears and What They Do

Below are the Muslim-origin founders and companies present on the list, with plain-English descriptions of what each product enables in a startup stack.

#3 - Replit: Amjad Masad, Faris Masad, Haya Odeh.

An AI-native developer environment where individual builders and teams can build, run, and ship software end-to-end; its recent “agentic” features have materially increased enterprise traction.

#6 - Cursor: Sualeh Asif.

An AI code editor that accelerates the path from edit to pull request to merge, increasingly used as a primary interface for day-to-day software work.

#9 - micro1: Ali Ansari.

A “human-intelligence API” that uses AI to vet, route, and coordinate elite engineering talent for companies that need output quickly.

#25 - Clay: Kareem Amin.

A go-to-market engine that enriches data and generates personalized outbound at scale, allowing small teams to test and iterate messaging rapidly.

#37 - 11x: Hasan Sukkar.

“AI sales reps” that handle prospecting and first-touch outreach to book meetings autonomously so human sellers can spend more time closing.

#42 - Alma: Aizada Marat.

A vertical AI platform that streamlines immigration workflows for employers and applicants where rules and documentation create natural bottlenecks.

#50 - Tavus: Hassaan Raza.

Personalized AI video and avatars for scalable one-to-many communication, often used to increase reply rates in sales and customer success.

Also notable (Iranian-origin founders, unable to confirm religious background):

#19 - Metaview (AI for interviews and recruiting)

#45 - Motion (AI scheduling and work management)

Both illustrate the depth of talent emerging from the broader region.

Our findings come from research we personally conducted and carefully reviewed.

🛒 What Startups Are Actually Buying, and Why

Startups are prioritizing developer copilots, GTM assistants, and vertical AI that demonstrate measurable impact within a quarter. Tools that reduce time-to-value, plug deeply into the stack (repos, ticketing, CRM), and then become costly to replace are earning increasing shares of budget. The a16z analysis also notes that categories like creative tools and “vibe coding” have broadened from niche departments to horizontal usage across roles.

Importantly, the market has not consolidated to one or two winners per function. Teams are assembling multi-tool stacks that compound ROI; e.g., pairing a dev copilot with a GTM copilot, so growth in one category often lifts adjacent categories.

🧭 Why This Matters for Dhow

For our community, this is more than a moment of representation; it is evidence that Muslim-origin founders are winning in categories where budgets are expanding. Replit’s rise to #3 on spend, alongside Cursor’s presence at #6, aligns with independent reporting on step-function growth in revenue and adoption for these developer platforms. That momentum reinforces the case for earlier, more organized capital into Muslim-led companies building in high-velocity segments of AI.

If you would like us to prioritize a specific company, reply “Deep Dive + {company}.”

⚠️ Methodological Caveats

This ranking reflects Mercury-visible spend and therefore may not capture all enterprise contracts or transactions routed through other providers. It still offers a strong directional view of where startup budgets are going. Our founder-origin mapping is compiled from public information and ongoing outreach and will be refined as new data comes in.

How a $25M Catalyst Could Bring Robotics Nationwide

Automation’s the future, but 71% of execs say upfront costs prevent its adoption. That’s why Miso Robotics’ new $25M hardware financing facility for customers turned heads. Miso’s AI-powered kitchen robots have logged 200k+ hours for brands like White Castle. With this $25M line and partnerships with NVIDIA, Amazon, it’s unlocking quick, flexible adoption of cutting-edge automation. Invest before Miso’s bonus shares change on 10/9.

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

If you enjoyed this, you’d be doing us a HUGE FAVOR by just clicking the ad above - we appreciate it!

Sources

a16z Enterprise: The AI Application Spending Report — Where Startup Dollars Really Go (methodology, categories, and list). (Andreessen Horowitz)

TechCrunch: Which AI companies startups are actually paying for (Mercury data, top-rank confirmations; Replit #3, Cursor #6). (TechCrunch)

TechCrunch: Replit’s position validated by the a16z report (context on the #3 rank among dev tools). (TechCrunch)

Reuters: Replit raises $250M at $3B; revenue acceleration context. (Reuters)

Financial Times: Cursor valuation and adoption context. (Financial Times)